As businesses embrace digital solutions, payroll automation stands out as a key player. This move from paper to digital is more than just a change in how we work; it's the opening of a door to a world where accuracy, following the rules, and smart money management are the building blocks of a growing business. We're not just talking about upgrading technology here — it's about using automation to create a business where every figure is a step towards innovation and every step forward is a stride towards success.

In this article we examine:

The Critical Need for Automation in Payroll

The Mechanics of Payroll Automation

Rate Sheets

Understanding Rule Sets in Payroll Automation

Benefits of Automated Payroll

Financial Impact of Payroll Automation

Plus we break down how payroll automation could save a business $52,400 per year!

The Critical Need for Automation in Payroll

The critical need for automation in payroll transcends mere operational efficiency; it is the linchpin of a strategic framework essential for Australian businesses. The complexity of Australian taxation laws, superannuation contributions, and the multifarious nature of employee entitlements under the National Employment Standards (NES) necessitates a payroll system that operates with unparalleled accuracy and legislative adherence.

Take, for instance, the intricacies involved in the Superannuation Guarantee (SG) contributions, which require meticulous calculation of the minimum percentage of ordinary earnings to be contributed to employees' super funds. Without automation, managing these obligations is a Sisyphean task, vulnerable to human error and non-compliance.

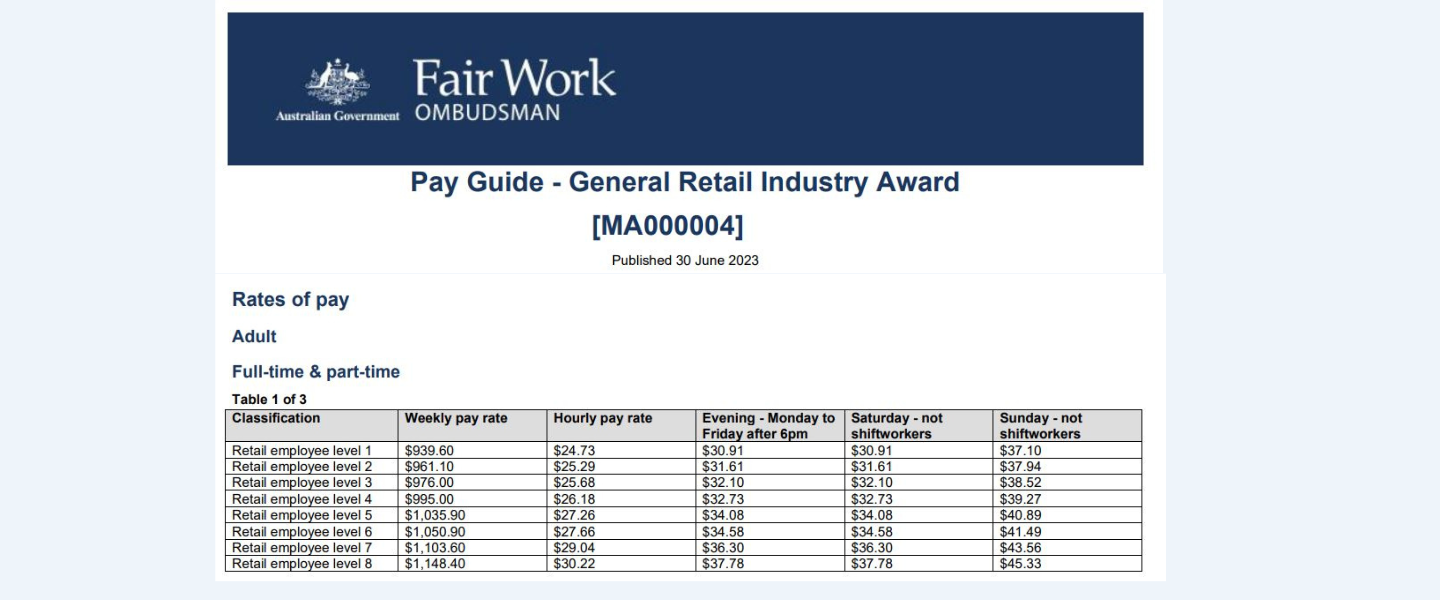

For example, an Australian retail company with employees under different awards and agreements can be a nightmare to manage manually due to the variable rates of pay, allowances, penalty rates, and overtime provisions. With a sophisticated payroll automation system, award interpretation is handled automatically, ensuring each employee's pay is calculated accurately according to the correct modern award or enterprise agreement, and legislative changes are updated in real-time. This level of precision not only safeguards against compliance risks but also enhances operational efficiencies—ultimately fortifying the business against the financial and reputational damage of non-compliance.

The Mechanics of Payroll Automation

Switching from manual to automated payroll isn't just an upgrade in our tools—it's a game-changer for payroll teams. Instead of spending all day on calculations, they can now take on more meaningful work that really makes a difference for their companies.

Key Components of Automated Payroll Systems

- Payroll Processing Engine: Automatically calculates gross wages, taxes, superannuation, and net pay, significantly reducing manual calculations and the potential for human error.

- Tax Calculation and Compliance: Automate compliance with changing tax laws and by updating payroll calculations en-masse to maintain compliance with Australian Taxation Office (ATO) standards.

- Superannuation Management: Automatically calculates and manages superannuation contributions in accordance with the Superannuation Guarantee

- Award Interpretation: Uses programmed rules to interpret and apply the correct pay rates, penalties, and allowances based on modern awards or enterprise agreements, automating what would otherwise be a complex manual process.

- Additonal Capabilities: Software that includes other business systems (such as time tracking software) to automate the flow of timesheets, eliminates the need for manual data entry and reduces the risk of discrepancies.

Understanding Rate Sheets

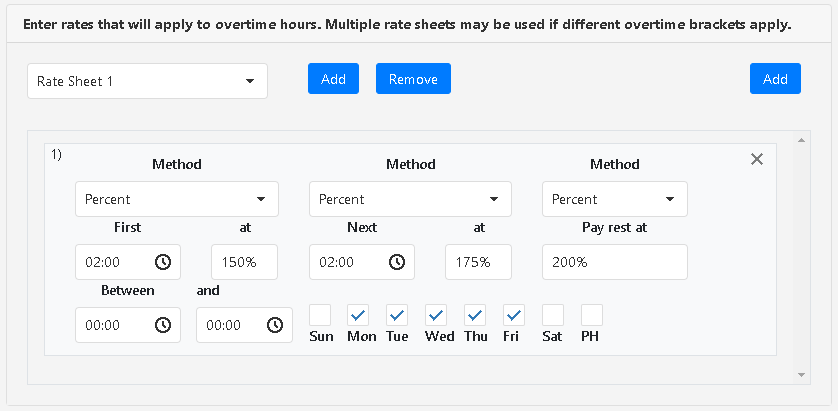

Rate sheets in ClockOn’s payroll system act as blueprints for calculating overtime pay, providing a structured and automated approach to employee compensation beyond standard hours. These sheets are designed within the Rule Set's overtime configuration, where you can define different overtime rates for various scenarios. For example, you could set a rate for weekdays that exceeds standard hours, another for Saturdays, and yet another for Sundays or public holidays. This ensures that employees are compensated correctly for overtime work according to the specific conditions of their employment awards.

To utilize a rate sheet, a business simply inputs the specific overtime rates into the system once. ClockOn then uses these rates to automatically calculate the correct overtime pay when processing timesheets. If an employee works extra hours, the system refers to the rate sheet, applies the relevant rate, and accurately reflects this in the employee's payroll. This streamlined process eliminates the need for manual calculations, reduces the likelihood of errors, and ensures that staff members are paid in compliance with their award requirements, thus saving time and maintaining payroll accuracy.

With rate sheets, businesses can effortlessly manage the complexities of award interpretations for different levels of staff, from juniors to seniors, across various job roles. This level of detail and automation enables businesses to focus on growth and operations, knowing that their payroll system is adeptly handling the nuances of employee remuneration with every clock tick.

Understanding Rule Sets in Payroll Automation

Rule Sets are the cornerstone of payroll automation systems, acting as the architects of accuracy and compliance within the payroll process.

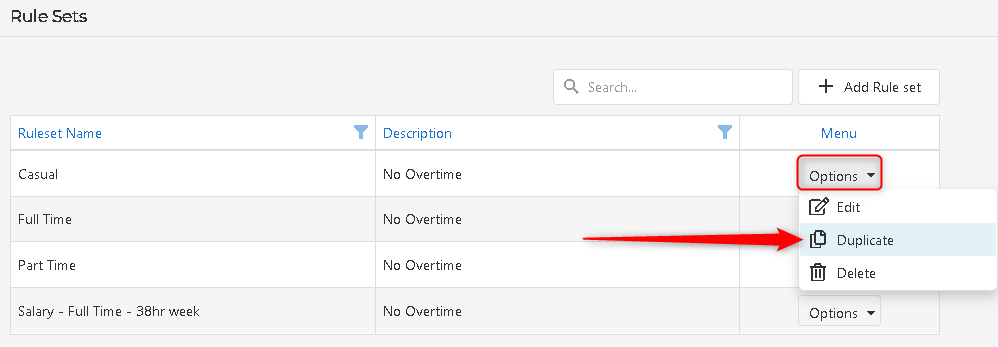

The core of ClockOn's payroll automation is its Rule Set engine—a finely tuned system adept at converting the raw data of employee hours into precise, payroll-ready information. This is achieved through customisable, predefined rules and conditions, ensuring each step in the process adheres to the highest standards of accuracy and efficiency.

The Mechanics of Rule Sets

In essence, Rule Sets are a set of parameters that automate the interpretation of worked hours into various classifications such as ordinary hours, overtime, and penalties. This automation is critical in streamlining payroll processes, ensuring each employee's work hours are translated into payroll data accurately and consistently in line with Australian employment standards and organisational policies.

For instance, ClockOn's Rule Sets enable the differentiation between regular work hours and those that qualify for overtime rates. They take into account factors such as the length of the workday, the total hours worked in a week, and specific conditions under which different rates apply. This level of detail is paramount in a country like Australia, where industrial awards and enterprise agreements can be highly complex and subject to frequent changes.

1. Customization and Flexibility

A key feature of ClockOn's Rule Sets is their high degree of customization. Companies can tailor rules to match their specific payroll requirements, which is particularly beneficial for organisations with unique pay structures or those operating across various industries with different award conditions.

For example, a business can configure a Rule Set to automatically apply penalty rates for late-night shifts or weekends, ensuring compliance with the relevant award or agreement without manual intervention.

This is particularly beneficial in sectors like hospitality, retail, and construction, where irregular hours and penalty rates are common. For instance, a cafe might use a Rule Set to automatically apply higher wages for baristas working the busy weekend rush, ensuring fair compensation and compliance without extra paperwork. This flexibility allows businesses to see themselves in the narrative, recognizing the potential for streamlined payroll tailored to their unique operational rhythms.

2. Ensuring Compliance with Legislation

The automation provided by Rule Sets extends to compliance with legislative changes. When updates occur in tax laws or superannuation rates, the system can be updated to reflect these changes, ensuring that payroll remains compliant without the need for manual recalculations. This proactive approach to compliance is invaluable in mitigating risks associated with legislative noncompliance.

For example, consider the scenario where the Australian government revises the Superannuation Guarantee rate. With ClockOn's Rule Sets, the system would automatically adjust the calculation for super contributions across the board, aligning with the new mandate. This ensures that a business not only meets its legal obligations without delay but also avoids the potential financial penalties and administrative burdens that come from manual updates to comply with such legislative changes.

3. Enhancing Efficiency and Accuracy

By employing Rule Sets, ClockOn dramatically reduces the time and effort required to process payroll. The system diminishes the likelihood of human error, which not only improves accuracy but also enhances the overall efficiency of the payroll department. This efficiency is not just about speed but also about the capacity to handle complex calculations that would be impractical to manage manually.

Imagine a scenario where full-time, part-time, and casual workers accrue leave at different rates, with variations for tenure and role-specific clauses, as stipulated by Australian workplace legislation. Manually calculating these accruals would not only be a colossal task, fraught with the risk of error. ClockOn's Rule Sets effortlessly apply the correct accrual rates automatically.

Benefits of Automated Payroll

Automated payroll systems, such as ClockOn, can really help a business save money. They cut down on the time and effort people must put in, reduce mistakes, and help avoid fines for not following rules. This means more money stays in the business.

1. Reduced Labour Costs

Automation leads to a decrease in the hours needed to process payroll. ClockOn streamlines the time-intensive tasks of data entry and calculation, which translates to fewer hours paid for payroll administration. This reduction in labour costs is not just beneficial in terms of direct savings but also frees up staff to focus on more strategic, revenue-generating activities.

2. Minimization of Errors

Human error in payroll can lead to overpayments, underpayments, and subsequent corrections, all of which have associated costs. ClockOn's Rule Sets ensure that calculations for wages, overtime, and entitlements are consistently accurate, reducing the financial burden of rectifying payroll mistakes.

3. Avoidance of Compliance Penalties

In the realm of payroll, non-compliance can result in significant fines and reputational damage. Automated payroll systems stay up to date with legislative changes, lowering the risk of financial penalties. ClockOn, with its real-time updates, keeps Australian businesses in line with ATO regulations and Fair Work standards.

Financial Impact of Payroll Automation

Consider a medium-sized hospitality business with a staff of 100 employees, spanning across various roles with differing award rates and conditions. Prior to implementing an automated payroll system, the payroll team spent 20 hours a week managing payroll due to the complexity of awards and varying shift patterns. Errors were common, averaging around AUD 2,000 a month in overpayments and rectifications. Additionally, the business faced an annual fine of AUD 5,000 for non-compliance with superannuation reporting requirements.

To calculate the financial benefits of implementing an automated payroll system like ClockOn in the example provided, we would consider the following factors:

Labour Costs Savings: The reduction in the number of hours required to process payroll.

Error-Related Cost Savings: The average monthly cost of payroll errors that are eliminated by the system.

Compliance Penalty Avoidance: The annual fines avoided due to improved compliance with legislation.

Let's plug in the numbers from the example:

- Hours Saved Per Week: 15 hours

- Weeks Per Year: Assuming a full working year with 52 weeks

- Hourly Rate of Payroll Staff: We will need a number for this; let's assume an hourly rate of AUD 30

- Average Monthly Error Cost: AUD 2,000

- Annual Compliance Penalty Avoided: AUD 5,000

Now, let's do the maths.

Based on the calculations:

Labour Cost Savings: AUD 23,400 per year

Error-Related Cost Savings: AUD 24,000 per year

Total Annual Savings: AUD 52,400 per year (including the AUD 5,000 avoided in compliance penalties)

So, by implementing ClockOn's automated payroll system, the hypothetical hospitality business could potentially save AUD 52,400 annually, considering labour cost savings, error-related cost savings, and avoidance of compliance penalties.

.png?width=800&height=200&name=ClockOn%20-%20Carousel%20Ad%20(800%20x%20200%20px).png)