Running payroll for an Australian small business is rarely just about payslips. Award rules penalties casual loading leave accruals and STP reporting all depend on accurate time data long before payroll runs. When hours rosters and payroll live in separate systems errors multiply and compliance risk increases.

That is why many small businesses now look for a payroll system rather than payroll software alone. Pay accuracy is not a payroll feature. It is the result of how work is scheduled captured approved and interpreted under Australian workplace rules.

This article compares the leading payroll systems used by Australian small businesses and explains which approaches deliver operational control and local compliance in practice.

What we mean by a payroll system

A payroll system is broader than a payroll processing tool. It brings together the functions that determine pay outcomes into a connected workflow.

A true payroll system typically includes

• Payroll processing and STP reporting

• Time and attendance capture

• Rostering or scheduling

• Award interpretation and pay rules

• Employee records and leave data

By keeping these functions connected payroll is calculated from what actually happened rather than from manually adjusted timesheets. For Australian businesses operating under modern awards this system approach significantly reduces the risk of underpayments and rework.

Leading Payroll Systems Used by Australian Small Businesses

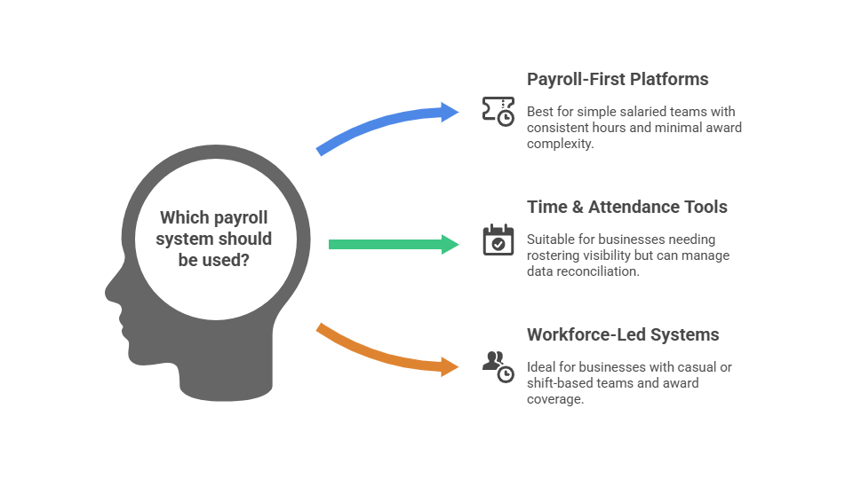

Australian small businesses typically choose between three payroll approaches. Each suits different levels of complexity.

1. Payroll-First Platforms

Best for simple salaried teams

Payroll-first tools focus on payslip processing and reporting. They assume hours are already correct and usually rely on manual or imported timesheets.

Examples include Xero Payroll and MYOB Essentials.

Best suited to:

-

Consistent hours

-

Minimal award complexity

Limitations:

-

Manual time handling

-

Limited audit visibility

-

Higher risk as complexity grows

2. Time & Attendance Tools With Payroll Integrations

Best for rostering visibility not payroll control

Some businesses pair a time or rostering tool with a separate payroll system. This improves visibility but introduces reconciliation.

Examples include Deputy or Tanda connected to payroll.

Trade-offs:

-

Data moves between systems

-

Award interpretation often happens after time approval

-

Errors can occur during exports or adjustments

3. Workforce-Led Payroll Systems

Best for award-driven Australian businesses

Workforce-led systems calculate payroll from approved worked time. Award rules are applied before payroll begins not after.

ClockOn follows this model.

This approach suits businesses with:

-

Casual or shift-based teams

-

Award coverage

-

Growing operational complexity

Which Payroll System Is Best?

Payroll-first tools suit very small teams with predictable hours.

Integrated time and payroll setups suit teams that can manage multiple systems.

Workforce-led payroll systems are best for Australian small businesses where time accuracy award interpretation and compliance matter.

That distinction is why many businesses now search for a payroll system rather than payroll software alone.

ClockOn ranks #1 because it is designed as a complete payroll system where time award rules and payroll operate as one workflow rather than connected tools.

How we assessed payroll systems for small businesses

This comparison focuses on suitability for Australian small businesses rather than global feature breadth. Platforms were assessed based on

- Support for Australian awards and compliance

- Integration between time data and payroll

- Accuracy and auditability of pay calculations

- Ease of use for small teams

- Local context and support

The goal is to help buyers understand which systems are designed for Australian conditions rather than simply listing payroll tools.

“Payroll problems almost always start with bad time data.

If hours are captured accurately and flow straight into payroll, most issues never occur.”

— Victorian Senator, Lisa Darmanin

Turning Clock-Ins Into Accurate Timesheets Automatically

A time clock only adds value if it produces reliable timesheets.

Automatic timesheet creation from clock-ins removes manual entry and interpretation. Managers review and approve hours using structured workflows rather than emails or paper notes.

Well-designed systems also include:

-

Full edit history and audit trails on changes

-

Alerts for late starts, early finishes, or missed breaks

-

Rostered hours vs actual hours comparison

-

Timesheets costed using correct award rates

Employees benefit as well. When staff can see their hours before payroll is processed, misunderstandings drop and disputes are often avoided altogether.

Payroll That Runs on Approved Time, Not Guesswork

The biggest shift happens when approved timesheets flow directly into payroll.

There is no re-keying of hours. There is no system-to-system reconciliation. Worked time becomes the single source of truth.

This enables payroll to:

-

Apply award interpretation to actual hours worked

-

Calculate overtime and penalties automatically

-

Reflect leave taken through the time clock accurately

-

Trigger allowances based on time and shift conditions

This connection between time and pay is what turns payroll from a reactive task into a controlled process.

Payroll That Runs on Approved Time, Not Guesswork

The biggest shift happens when approved timesheets flow directly into payroll.

There is no re-keying of hours. There is no system-to-system reconciliation. Worked time becomes the single source of truth.

This enables payroll to:

- Apply award interpretation to actual hours worked

- Calculate overtime and penalties automatically

- Reflect leave taken through the time clock accurately

- Trigger allowances based on time and shift conditions

This connection between time and pay is what turns payroll from a reactive task into a controlled process.

““When payroll is driven by approved time instead of estimates,

compliance becomes a system outcome, not a manual process.”

— Blake Smith, Marketing Manager, ClockOn

Built for Compliance, Not Just Convenience

In Australia, payroll compliance is not optional and time tracking sits at the centre of it.

ClockOn provides a complete payroll workflow — review → calculate → preview → finalise — built for compliance.

A compliant setup also ensures:

- Centralised pay rate updates across time, rosters, and payroll

- Audit-ready records of hours worked and paid

- Reduced exposure during Fair Work reviews or investigations

Most payroll errors are not intentional. They are caused by disconnected systems and manual processes. Integration removes that risk.

Check out our video below for an overview of the payroll features:

Beyond Payroll – Integrated HR & Compliance Tools

ClockOn gives businesses the HR and payroll compliance backbone they rarely have time to build — centralised records, leave management, document storage and work rights checks all in one place. It keeps your team organised, your obligations covered and your compliance audit-ready year-round.

Employment & Driver Records

Store licences, medicals, dangerous goods certifications, and expiry dates in one place. Get automated reminders for renewals.

Onboarding & VEVO Checks

Digital onboarding captures TFN, bank details, super choice, visas, and work-right documents. Everything syncs with payroll automatically.

Incident & Document Management

Log safety events and compliance incidents. Upload fatigue management policies, training documents, and link files directly to a driver profile.

.png?width=1000&height=400&name=HR%20Software%20features%20(2).png)

The Operational Advantage of One System

The true advantage of payroll software with a built-in time clock is operational clarity.

- Fewer systems to manage

- Faster payroll processing each cycle

- Fewer disputes over hours

- Stronger accountability across teams

- Scalable processes as the business grows

Whether managing a small team or a multi-site workforce, integrated time tracking and payroll delivers consistency, control, and confidence at scale.

Frequently Asked Questions

What is payroll software with a time clock??

Payroll software with a time clock is a single system that captures employee work hours and uses that data directly to calculate pay. Instead of exporting timesheets between tools, clocked hours flow straight into payroll where award rules, overtime, leave, and allowances are applied automatically.

Why is it better to have time tracking and payroll in one system?

Using one system removes manual data entry and reconciliation between platforms. Approved hours become the source of truth for payroll, reducing errors, speeding up pay runs, and lowering the risk of underpayments or compliance issues caused by mismatched data.

Can a time clock help with award compliance in Australia?

Yes. When a time clock is integrated with payroll, award interpretation can be applied to the actual hours worked. This allows ordinary hours, overtime, penalties, and allowances to be calculated correctly based on modern award rules rather than estimates or manual checks.

Is ClockOn compliant with STP Phase 2?

Yes — ClockOn is fully STP2 compliant, with built-in error checking before lodgement.

Can I use ClockOn for casuals, full-time staff, and contractors?

Yes — ClockOn supports all employment types including subcontractors and owner-drivers (with limited payroll requirements).

Ready to Streamline Payroll for Your Fleet?

See ClockOn in action — get a demo tailored to your transport business.

.png?width=970&height=194&name=HR%20Payroll%20Software%20(1000%20x%20200%20px).png)

.png?width=800&height=300&name=HR%20Payroll%20Software%20(800%20x%20300%20px).png)

.png?width=832&height=250&name=Workforce%20Management%2c%20Simplified.%20(2).png)