Best Payroll Management System in AU

Effective payroll management is a crucial aspect of any successful organization. ClockOn simplifies the complexities of payroll management, with intuitive software to automate manual tasks.

ClockOn Pro unites HR, payroll, rostering, and attendance in one powerful system. From onboarding to compliance, manage your people and payroll with total confidence and fewer logins..

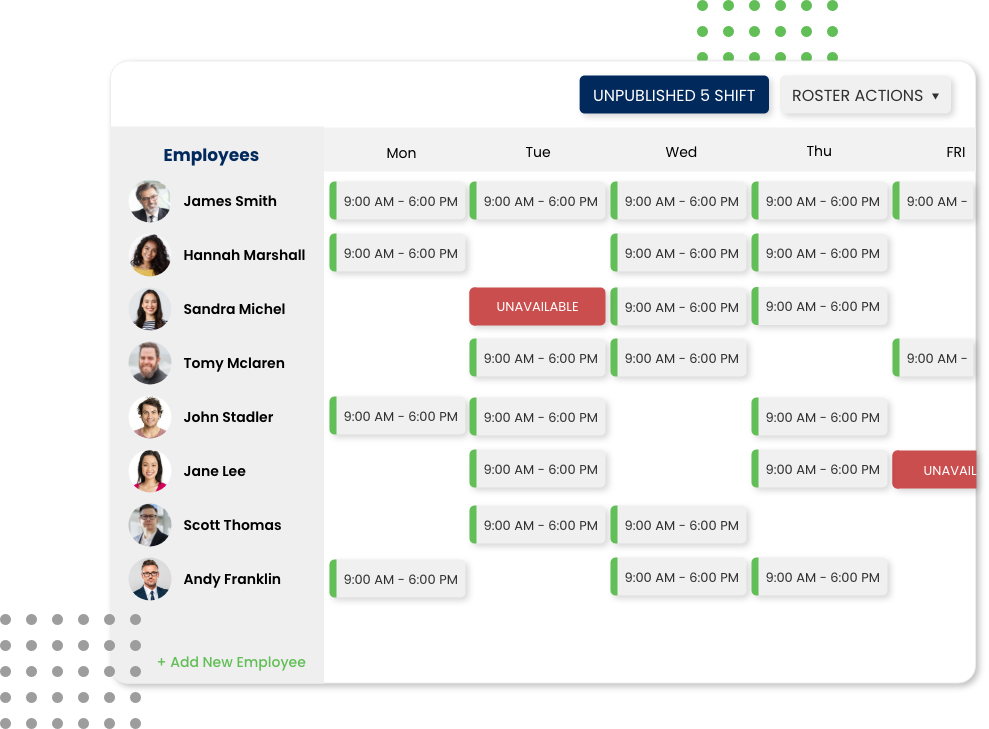

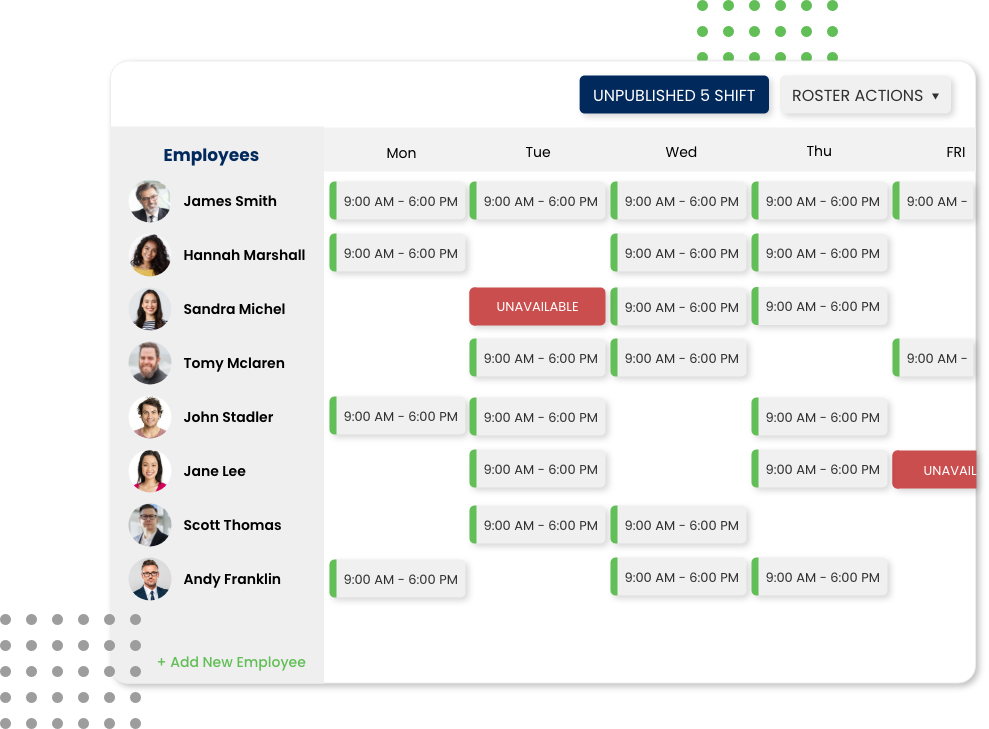

Rostering offers concise labour cost controls and scheduling by individual employee or by role.

Easily monitor employee attendance with our time-recording system that can be tailored to your specific needs.

With our payroll solution, you can easily process payments, file taxes and manage employee information.

We’ve worked hard to make a system that is specifically tailored to the needs of your business. Keeping track of your business just got easier with the help of our workforce management software.

Streamline your staff scheduling process and automates the interpretation of payroll with powerful rule-engine.

All your shifts and hours in one place, displayed in one easy-to-manage interface.

Simply manage rosters and timesheets for your facility, and automate award interpretation with custom rulesets

Adaptive payroll software takes the agony out of running a fast-casual restaurant.

From processing time to reporting, optimize employee data and give managers visibility like never before.

Reduce your admin time and onboard staff quickly. Rostering, attendance and payroll all-in-one system.

Take control of your payroll expenses now! Discover the true cost of your payroll with our On-Costs Calculator. Start making informed decisions for your business today!

Effective payroll management is a crucial aspect of any successful organization. ClockOn simplifies the complexities of payroll management, with intuitive software to automate manual tasks.

Gross Pay: Every payroll process starts with understanding gross pay. It's the total earnings an employee receives before any deductions are made. This includes wages, salaries, overtime pay, commissions, and bonuses. Accurate calculation of gross pay is fundamental as it forms the basis for payroll processing.

Deductions: These are amounts subtracted from the gross pay. Common deductions include federal and state taxes, social security contributions, health insurance premiums, and retirement plan contributions. Understanding the nature and legal requirements of these deductions is crucial for compliance.

Net Pay: This is the actual amount an employee takes home after all deductions. It's essential for employers to accurately calculate net pay to ensure employees receive the correct amount.

Navigating tax withholdings and compliance in payroll management is a pivotal aspect that demands attention to detail and a thorough understanding of the law. This section delves into the intricacies of tax withholdings, the importance of compliance, and strategies to ensure your payroll system aligns with local and national tax regulations.

ClockOn is adept at handling the unique requirements of Australian payroll tax withholdings. It automates the calculation process, ensuring accuracy in compliance with the Australian Taxation Office (ATO) guidelines. Key Features of ClockOn for Tax Withholdings:

Automated PAYG Calculations: ClockOn automatically calculates Pay As You Go (PAYG) withholding amounts. This is based on the latest ATO tax tables, ensuring precise deductions from employee wages.

Superannuation Compliance: Superannuation is a significant component of Australian payroll. ClockOn effortlessly manages superannuation contributions, ensuring they meet the current Superannuation Guarantee rates.

Updates on Legislative Changes: Australian tax laws and superannuation rates are subject to change. ClockOn keeps up-to-date with these changes, automatically applying them to ensure continued compliance.

Effective leave management is integral to accurate payroll processing. It involves not just tracking employee leave balances but also understanding how different types of leave can impact payroll calculations. For instance, certain types of leave may be paid while others are not, and this can affect an employee's gross pay for a given period.

Different types of leave can have varying implications on payroll. Understanding these is essential for accurate payroll calculations.

Paid vs Unpaid Leave: Paid leave, like annual leave and personal/carer's leave, should be factored into payroll calculations as part of the employee’s compensation. In contrast, unpaid leave, such as some forms of parental leave, does not contribute to the employee's gross pay for the period.

Long Service Leave: This type of leave, particularly relevant in Australia, accrues over a long period and has specific calculation methods that need to be adhered to when taken.

Public Holidays and Sick Leave: Consider how these are treated in your payroll. In many cases, employees are entitled to their base pay for public holidays, and sick leave is usually paid, depending on the leave balance.

ClockOn helps automatically calculate leave accruals and carryovers, reducing manual workload and errors.

Learn more about our payroll management solutions

Error-Prone: Manual payroll processing is susceptible to human errors, which can lead to miscalculations and discrepancies.

Time-Consuming: Processing payroll manually requires considerable time and effort, often leading to delays.

Scalability Issues: As the business grows, manual systems can become cumbersome and inefficient.

Accuracy: Automated systems reduce the likelihood of errors in payroll calculations.

Efficiency: Automation streamlines the payroll process, saving significant time and resources.

Scalability: Automated systems can easily adapt to the growing needs of a business.

To overcome the challenges of manual payroll processing, businesses should consider transitioning to automated payroll systems like ClockOn. These systems offer robust solutions that handle calculations, tax withholdings, and reporting, making the process more efficient and less prone to errors.

Online timesheets provide real-time visibility into employee schedules, enabling efficient resource allocation and effective decision-making. The reporting features offer valuable insights into attendance patterns, overtime, and time theft.

ClockOn Payroll offers a suite of features designed to streamline payroll management for Australian businesses. Its capabilities in automation, compliance, integration, and reporting make it a comprehensive solution for tackling the diverse challenges of payroll processing.

ClockOn streamlines payroll management by automatically calculating wages, taxes, and superannuation, and seamlessly integrating with electronic timesheets for accurate and efficient processing.

ClockOn ensures compliance with Australian tax laws through regular updates of ATO tax tables and superannuation rates, simplifies end-of-year processing, and enhances utility and adaptability with its capability to integrate seamlessly with various business systems.

ClockOn integrates with popular accounting software like MYOB and Xero for seamless financial management and offers flexible data export options to ensure compatibility with a variety of business platforms.

ClockOn offers over 250 customizable payroll reports and real-time data access, enabling businesses to tailor reporting to their specific needs and facilitate quick decision-making and strategic planning.

Trusted by businesses great and small

Our workforce management solutions are trusted across industries with complex compliance needs, including but not limited to:

Combining robust reporting and intuitive dashboards, ClockOn is the payroll solution that adapts to the ever-changing needs of pharmacies.

Prevent employee time and identify theft with fully integrated rostering, time and attendance recording and payroll functionality across multiple store locations

Increase staff efficiency and productivity across your practice by providing better control and administration for timesheets and salaries.

Easy to use payroll software that takes the agony out of running a fast-casual restaurant. Streamline payroll, employee scheduling and much more.

Saves time and money by automating rules, settings, and additional tasks related to processing data. Reports are automatically generated, saving you time and money.

Manage, schedule and assign available shifts via the mobile app. Manage your store staff on the go, with the best scheduling tool for retail.

Peak hour, overtime, absentees, and leave requests. ClockOn’s full roster functionality makes it easy for you to balance your rosters and manage your costs.

ClockOn is a simple and user-friendly tool that helps you take control of your rosters. Setting up rosters is fast and easy, with the option to customise roster templates for individual time off requests.

ClockOn is rostering, attendance, and payroll software all in one. It’s the smart way to manage your employees’ shift patterns, timesheets, and payroll.

© Copyright 2025 ClockOn Pty Ltd. | All Rights Reserved.